Central Research Topics

- Behavioral Control

- Incentive Systems

- Communication and Reporting

- Information Perception

- Information Processing

- Neuro-Accounting

- Information Visualization and Visual Attention

- Cognitive Costs and Mental Effort Measures

Current Projects

The objective of the project is to investigate the underlying mental processes of decision-making behavior in different contexts. The results will provide implications for further experimental accounting research investigating the cognitive processes in decision-making and judgment processes based on accounting information. This research is conducted in cooperation with the Chair of Marketing at the Goethe University Frankfurt (Prof. Dr. Torsten Bornemann) and the Hertie-Institute for Clinical Brain Research & Dept. Psychiatry and Psychotherapy, University Hospital Tuebingen (PD Dr. Axel Lindner).

In this research project, we use functional magnetic resonance imaging (fMRI) to record individuals’ mental effort in a decision based on accounting information. Our results provide implications for a wide range of accounting issues. For example, the design of increasingly used interactive accounting reports based on real-time data can benefit from our findings.

The key objective of this project is to analyze the effects of reporting frequency of earnings data. Using eye tracking, which enables us to disentangle two separate reporting frequency effects – the effect of scaling (vertical axis) and the effect of data points (horizontal axis), the results of this project will provide implications for investment behavior and earnings forecasts of nonprofessional investors.

Incentive systems are motivating employees in the interest of the company owners by tying performance metrics to a measurable input, output or outcome. The performance evaluation is influenced by discretionary elements. For example, individual’s communication skills are evaluated by using a rating scale. The rating may be influenced by a biased evaluator who favors certain employees over others. This is just one example of the room for discretionary decisions in performance evaluation. It is the focus of this project to analyze – using behavioral experiments – how and when discretion influences perceived fairness, motivation, and behavior.

Clawback provisions are intended to prohibit employees’ misconduct by recovering incentive payments following a material misstatement, compliance violation or breach of duty. The supervisory committee may define provisions that cover more trigger events and more incentive compensation elements (e.g., bonus and pension funds). In the project, secondary data analysis is used to investigate, which companies implement clawback provisions to prevent future misconduct and which trigger events are defined in the compensation contract. Furthermore, experimental research is used to investigate how employees adjust their risking-taking and decision behavior following the implementation and execution of clawbacks.

Link: Consolidated clawback provisions of German DAX30 & MDAX companies of 2018

Link: Consolidated clawback provisions of German DAX30 & MDAX companies of 2019

To investigate influencing factors of honesty in managerial reporting settings, we conduct experimental research.

Contributing Scholars

Contributing External Scholars

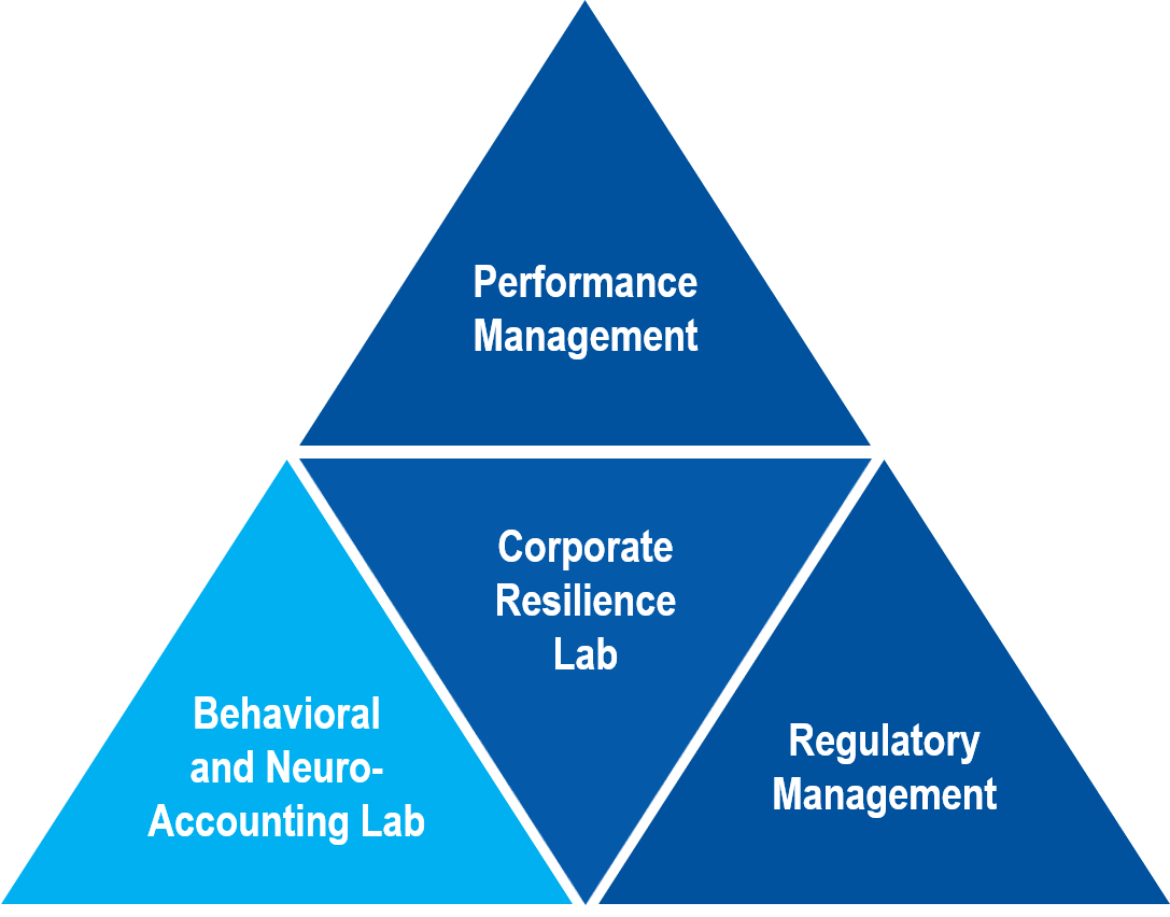

For more information on the Research Cluster Behavioral and Neuro-Accounting Lab contact:

Selected Publications

Müller, F./Tank, A. (2021), Easier said than done: The effect of ARUG II on clawback provision adoption and the diversity of clawback trigger events in German DAX30 & MDAX companies, Working Paper, Lehrstuhl für Controlling, Universität Stuttgart.

Tank, A./Farrell, A. (2021), Is neuroaccounting taking a place on the stage? A review of the influence of neuroscience on accounting research, in: European Accounting Review, Special Issue “Literature Reviews in Accounting”, forthcoming

Rötzel, P./Pedell, B./Groninger, F. (2020), Information load in escalation situations: combustive agent or counteractive measure?, in: Journal of Business Economics, Vol. 90, 2020 (5-6), pp. 757–786

Tank, A./Müller, F. (2020), Clawbacks und ihre Bedeutung für das Controlling, in: Controlling, Vol. 32, 2020 (4), pp. 50-53

Müller, F./Rieber, D./Tank, A. (2020), Legal bases and implementation of clawback clauses: Comparison between Germany and the US, in: KoR – Zeitschrift für internationale und kapitalmarktorientierte Rechnungslegung, Vol. 20, 2020 (3), pp. 132-137

Fehrenbacher, D. D./Rötzel, P. G./Pedell, B. (2018), The influence of culture and framing on investment decision-making: the case of Vietnam and Germany, in: Cross Cultural & Strategic Management, Vol. 25, 2018 (4), pp. 763-780.

Fehrenbacher, D. D./Kaplan, S. E./Pedell, B. (2017), The relation between individual characteristics and compensation contract selection, in: Management Accounting Research, Vol. 34, 2017 (1), pp. 1-18

Tank, A. (2016), Einflussfaktoren auf die neuronalen Prozesse in ökonomischen Entscheidungssituationen, in: Ach, J. S./Lüttenberg, B./Nossek, A. (Hrsg.), Neuroimaging und Neuroökonomie – Grundlagen, ethische Fragestellungen, soziale und rechtliche Relevanz, 2015, Münster, pp. 41-54.